RGGI Auction 56 update: RGGI Auction Clears At $13.90 | Emissions Watch Blog

Clearing Price of $13.90/ton Marks the highest clearing price ever

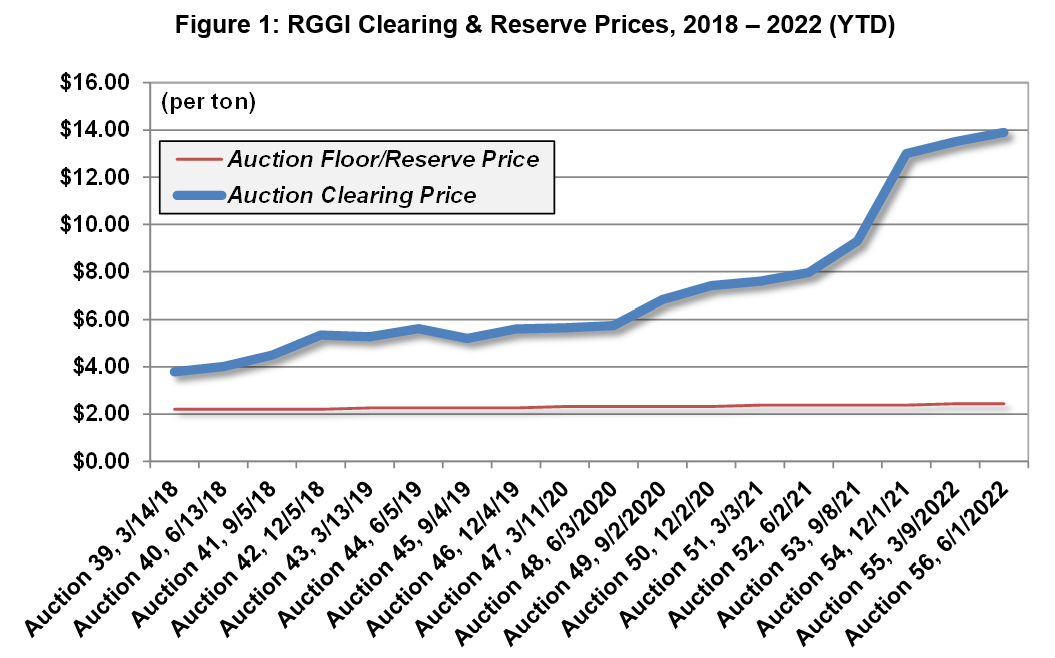

The most recent RGGI quarterly auction (Auction 56) was held on June 1, 2022. The clearing price was $13.90/ton, three percent higher than the clearing price of $13.50/ton on March 9, 2022 (see Figure 1).

Clearing Price of $13.90/ton Marks the highest clearing price ever

The most recent RGGI quarterly auction (Auction 56) was held on June 1, 2022. The clearing price was $13.90/ton, three percent higher than the clearing price of $13.50/ton on March 9, 2022 (see Figure 1). Although the clearing price was only slightly higher than the most recent auction, the $13.90/ton price marks the highest clearing price since the start of the program. Notably, the clearing price fell just short of the 2022 Cost Containment Reserve (CCR) trigger price. The CCR provision is a mechanism that allows the release of additional allowances when auction prices exceed an established price threshold (the trigger price). The CCR trigger price acts as a soft price cap. The CCR provides a quantity of additional allowances up to 10 percent of the total annual cap (2022 CCR; 11,611,278 allowances). The CCR allowances are sold in an auction only if the allowance price would otherwise exceed the trigger price, which was $13.91/ton for all 2022 auctions.[1] In this auction, no CCR allowances were sold since the clearing price did not exceed the CCR trigger price.

[1] The CCR trigger price increases by 7 percent each year.

Auction 56 Specifics

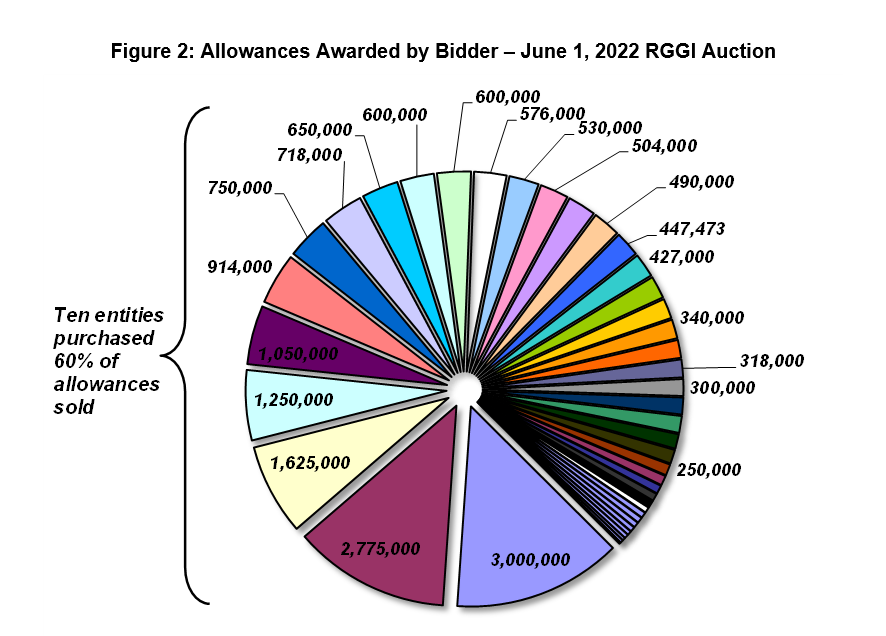

Bidding interest was strong in Auction 56 and 22,280,473 allowances were sold. Sixty-nine entities submitted bids and the quantity of allowances for which bids were submitted was 2.6 times the available supply. Fifty-nine bidders secured allowances, with ten bidders purchasing 60 percent of all the available allowances. Figure 2 shows the breakdown of allowances sold to each of the successful bidders.

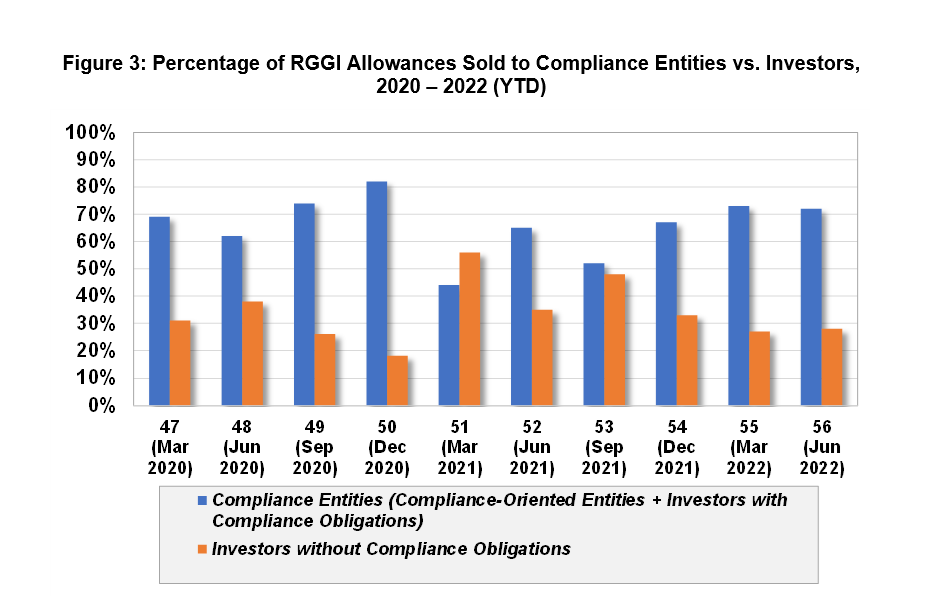

The Market Monitor report for Auction 56 indicated that following this auction, 49 percent of allowances in circulation were held by compliance entities and 51 percent were held by non-compliance entities. Figure 3 shows the percentage of allowances sold to compliance entities versus investors. In this auction, compliance entities purchased significantly more allowances than investors (72 percent versus 28 percent).

ESAI provides a detailed analysis of the RGGI market, including an allowance price forecast, emissions projections, and updates on relevant policy and regulatory developments. For more information on how to access this information, contact [email protected]

Learn About Emissions Watch

This quarterly publication contains ESAI Power’s outlooks and views on the emissions markets. ESAI provides regular updates and analysis on developments in the SO2, NOx and CO2 emissions markets as well as price forecasts for state and regional markets. In addition, regular updates are provided on the RGGI program as well as other state-specific emissions programs.

Learn About Energy Watch Quarterly

Energy Watch QuarterlyTM provides a quarterly analysis of market and policy issues affecting energy pricing dynamics over the next 10-year period for both the power and natural gas sectors. This analysis includes forecasts of pool-wide and zonal energy prices in New England, New York, and PJM, including forecasts of fuel inputs. Supporting assumptions are provided in each quarterly report.